CLIMATE CHANGE RISK

Climate change resilience will be key to sustaining value in the real estate sector

Already in 2021 we developed and implemented a climate risk tool for our portfolio, which allows us to take potential physical risks to real estate as a result of climate change into account in our investment proposals for both new acquisitions and significant redevelopments.

Climate risk

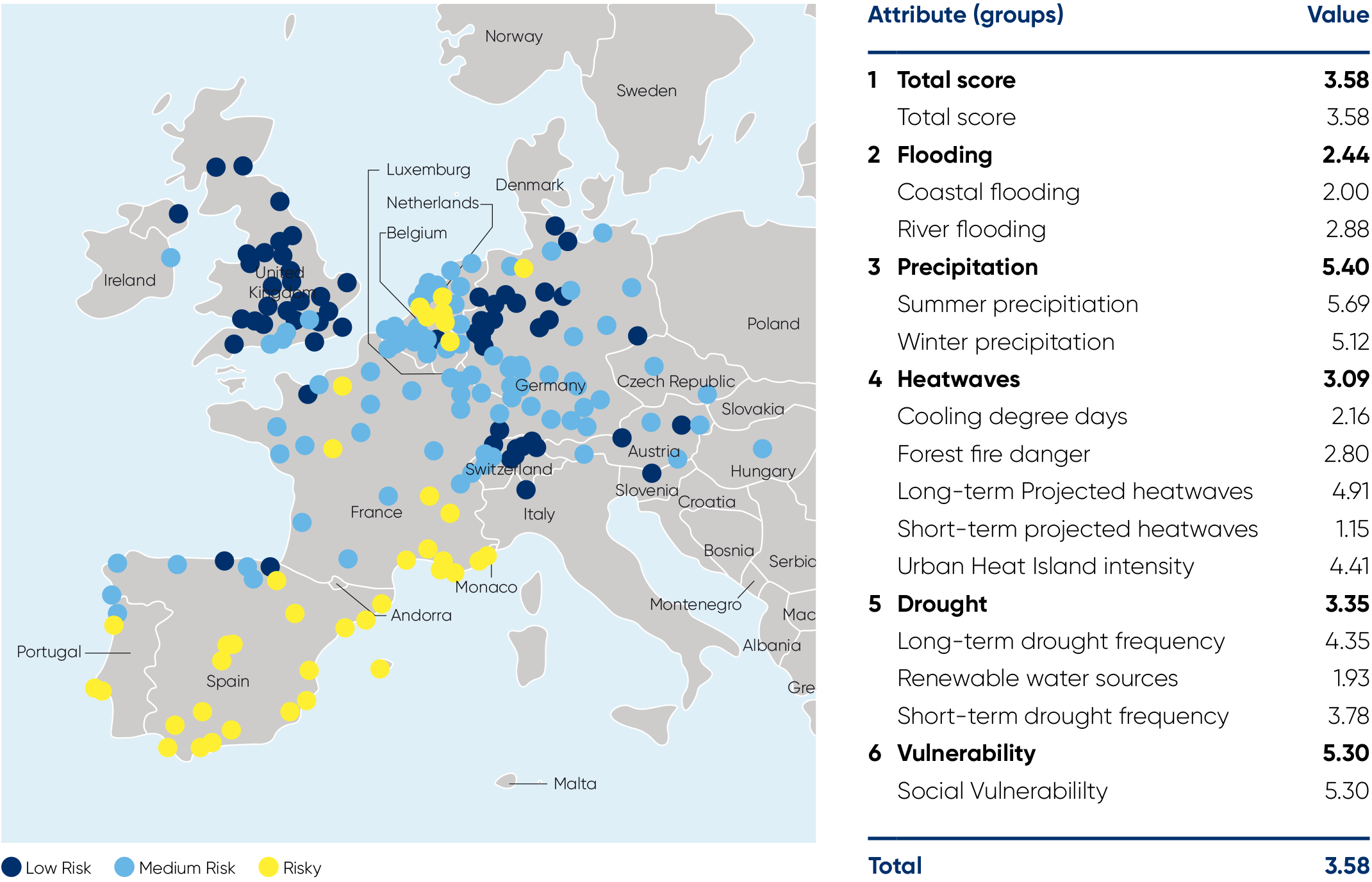

Already in 2021 we developed and implemented a climate risk tool for our portfolio, which allows us to take potential physical risks to real estate as a result of climate change into account in our investment proposals for both new acquisitions and significant redevelopments. The tool is based on data from the European Environmental Agency which looks at key physical risks such as flood risk (river flooding, pluvial flooding and sea-level rises), heat stress including urban heat island effects and drought risk or water availability. By signalling these risks at city level in our acquisition and development process, the intention is to spur deliberate thought on mitigation measures that need to be evaluated in the due diligence process for acquisitions, or incorporated in the design phase for redevelopments, and explicitly included in the underwriting of the business case. For each of the physical risks, our tool also includes a few examples of possible mitigating actions. Whilst the tool currently looks at these risks at a city level – which is sufficient to raise awareness and spur thought – we recognise that we can further sharpen our tooling in the future to assess these physical risks (as well as transition risks) at a much more granular, asset level. This will be work in progress in the year(s) to come.

During 2022 the relevant proposal templates have been updated and giving this topic deliberate attention in the process is starting to result in more detailed commentary on possible mitigating actions. We consider this to be part of the learning journey and expertise building of the relevant colleagues so that acquisition opportunities or redevelopment projects are being evaluated with these longer-term risks in mind, ultimately with the aim to ensure that our assets under management can be considered to be ‘climate resilient’, which will impact risk perception, value and liquidity in the investment market.

“Climate risk is hard to fathom...until it happens close to home.”