NET ZERO CARBON PORTFOLIO

Mission 2040 coming to life

With the launch of Mission 2040 formally taking place in Q4 2019, we’re now a little over three years into our net zero carbon journey. Looking back, the first years were really about getting the foundations in place to allow us to execute on our mission.

This entailed setting up processes and procedures to measure our progress, creating awareness and supporting our local teams with understanding the impact of our new mission. Today the organisation is learning to make deliberate decisions that will contribute to achieving our goal of a net zero carbon portfolio in 2040. In order to achieve our goal, we follow four steps towards Net Zero Carbon, which have also been described and communicated in our visual roadmap.

Mission 2040 is our commitment to making our entire portfolio of assets under our management Net Zero Carbon by 2040. Our approach is aligned with the World Green Building Council’s definition of Net Zero Carbon, meaning that buildings must be highly energy efficient and disconnected from fossil fuel use for heating or hot water, with the remaining energy needed to operate fully delivered by on-site and/or off-site renewable energy sources.

1. Measure and disclose energy consumption and emissions

The process of improving assets starts with gaining insight into their energy consumption and emissions. For a few years now, we have been working hard to improve the completeness, accuracy and robustness of energy consumption data relating to our assets under management (AuM), both for common areas as well as tenant spaces. To make this process as automated and efficient as possible, we have been investing in smart meters to capture energy consumption data across our AuM. We capture data for electricity, natural gas, fuel oil, and district heating or cooling where this is relevant at asset level. By the end of 2022, we have managed to increase the smart metering coverage to 88% of the commercial rental spaces in our AuM, excluding our residential assets, our development projects currently in the pipeline and the assets held for sale. Smart meters will be installed in the development projects as they move towards completion, and we are still seeking how to best deal with residential assets, where we have a greater challenge with privacy concerns.

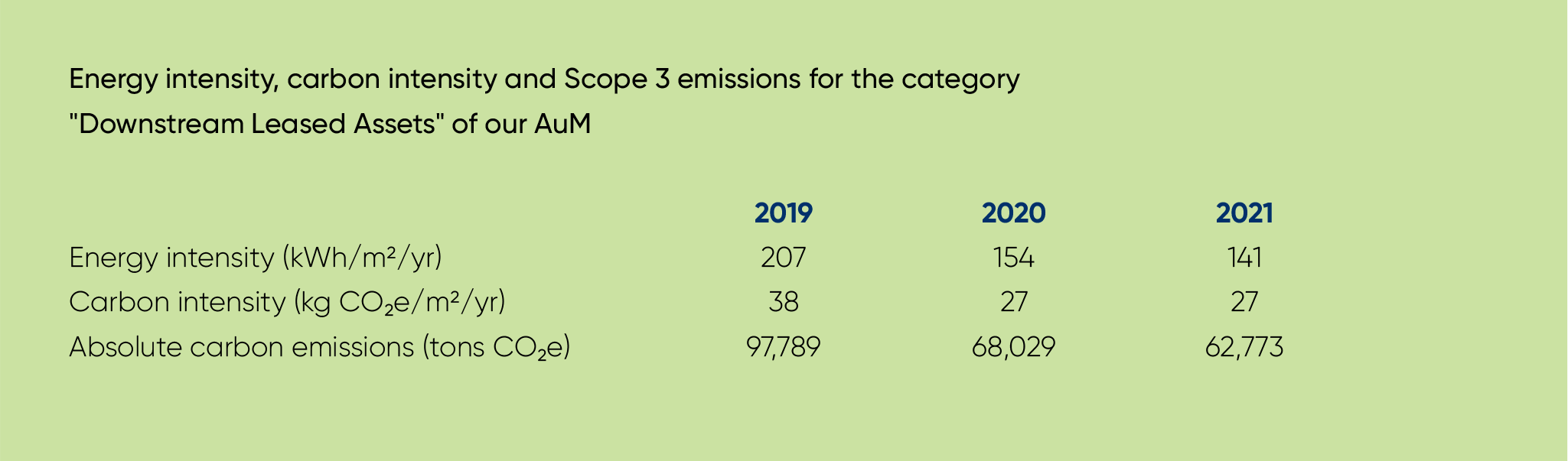

To set a reduction target we need a baseline: we have selected 2019 as our baseline year as this is the last pre-COVID year. 2020, 2021 (and to a lesser extent 2022) are not necessarily representative as government-mandated restrictions resulted in retail store closures, working-from-home requirements and other restrictions that impacted relevant energy consumption and corresponding carbon emissions. In this report, we present the energy intensity (kWh/m2/year), carbon intensity (kg CO2e/m2/year) and absolute CO2e emissions (tons CO2e) for our AuM for the years 2019 to 2021. (These data points therefore exclude the AuM managed by redos, which Redevco only acquired in 2022.)

We have not been able to collate the 2022 data for our AuM to allow for this to be included in a timely fashion for the assurance process of this report*. With our smart meter coverage having been significantly increased towards the end of 2022, we are hopeful that in future editions of this report, we will be able to present the reporting year’s data immediately after the close of the year. Please see the sidebar below for the AuM energy intensity (EI), carbon intensity (CI) and corresponding absolute emissions, which correspond to the largest share of our total Scope 3 emissions, and are thus the most important category of emissions for our net zero carbon reduction target. Given the impact of COVID-19 restrictions across our AuM for both 2020 and 2021, the data points presented here are not comparable to our baseline year, so no further commentary is warranted. When we are able to present the 2022 scope 3 downstream leased assets emissions, it will be a more relevant comparison to our baseline year and we expect to present more transparently where we are on our emissions reduction journey.

*As soon as the AuM energy consumption and corresponding emissions data for 2022 becomes available and has been properly vetted, we intend to publicize our progress on our emissions reduction journey via a press release later this year.

2. Reduce energy demand

At every natural intervention moment in an asset’s lifecycle, we aim to take deliberate decisions to target a significant reduction in energy demand. We take a ‘fabric first’ approach: first maximising the performance of the components and materials that make up the building fabric and then working with tenants to reduce the operational energy demand. When redeveloping an asset, we will also disconnect it from fossil fuel supplies where possible. We launched our new Sustainable Design Guide during the course of 2022 as a tool to determine the ambition level and corresponding targets relevant to each individual project at the very outset of that project, with the intention to rally the full design and project team around the objectives at hand and the contribution towards our overarching Mission 2040 goal.

We have used the Sustainable Design Guide retroactively on a few projects that were already further along into detailed design such as Groningen and Hamburg. For projects in Oxford and Glasgow, for example, the Sustainable Design Guide has been implemented from the very beginning, which we hope will feed through to clear energy intensity performance levels post-completion. However, for all projects already in our development pipeline, the attention for our Mission 2040 ambition is clearly articulated in our development proposals and our teams make deliberate choices wherever possible to drive down operational energy demand.

Naturally, our redevelopments offer a key moment in a building’s lifecycle to have the biggest impact on its environmental performance. After already many years of using and reporting on our progress using BREEAM (see previous editions of our RI Report), we have raised the ambition for significant redevelopments to target a BREEAM In-Use ‘Excellent’ rating.

BREEAM is a well-recognised, international standard that takes a holistic approach to measuring the environmental performance of real estate assets.

3. Generate balance from renewables

On-site renewable energy generation is an integral part of journey towards Scope 3 operational net zero carbon emissions. We initiated “Project Solar” in 2020, initially focusing on the roofs of our larger, retail warehouse park assets in Belgium. Through the installation of solar panels on the roofs of these buildings, Project Solar provides on-site, emission-free energy to those tenants with whom we are collaborating on this initiative. You can read more about this project here.

4. Improve verification and rigour

We recognise that our approach towards Net Zero Carbon is also one of continuous improvement -taking learnings and best practices from previous initiatives and projects and apply those to current and future projects. This means evolving over time from an operational carbon focus to a whole life carbon approach. Therefore, we are starting to take upfront embodied carbon emissions and potential end-of-life emissions into consideration when developing and redeveloping assets. Embodied carbon are emissions related to the materials, transport, construction, maintenance and deconstruction of real estate assets. These emissions relate to the materials, transport, construction, maintenance and deconstruction of real estate assets. As this is still relatively new for the real estate sector, we are working with our supply chain partners (architects, advisors and construction companies) – also through our Sustainable Design Guide – to take a deliberate approach to understand the trade-offs in order to drive down the upfront embodied carbon emissions of our various projects, especially where structural works are included in the program. This is work in progress, as is the best way to measure, record, reduce and report on these upfront embodied emissions.

At Mönckebergstrasse 9 in Hamburg, Germany a new sustainable building will arise with a floor space of around 15,000 sqm across ten floors. We have dedicated a RedevCast episode on this redevelopment project using mass timber.

Challenges in our Net Zero Carbon roadmap

Energy transition

The transition to a Net Zero Carbon portfolio is one of Redevco’s top priorities and we are aware that this transition will be characterised by uncertainties, changes and risks. We recognise that the entire built environment sector is still learning how to tackle the energy transition and other uncertainties such as the pace of the transition, government policies, technological developments and changing consumer behaviour.

Collecting reliable and accurate data

One of the reasons we haven’t been able to present our AuM energy consumption and carbon emissions data until now is that we simply didn’t have robust nor complete enough data to present and to permit proper assurance of the data. We reported previously that our efforts in the past were laborious and time-consuming and added little value to our tenant relationship, because we simply did not have the tooling to report back. However, we know that reliable and accurate energy and emissions data underpins Mission 2040 and our journey to becoming Net Zero Carbon. Over the past three years we have steadily worked on installing smart meters in the majority of our properties, connected to country platforms and from there to a pan-European platform. We have working connections with most energy management software installed at country level. Whilst the data covering 2019 to 2022 is still greatly shaped by estimations and extrapolations, we are confident that from 2023 onwards, we will be able to base a significant portion of our downstream leased assets (Scope 3) emissions reporting on actual consumption data. This will also allow us to report and engage with our tenants on energy consumption and energy saving opportunities and will help us report on progress towards our Mission 2040 target.

Measuring and reporting on upfront embodied carbon emissions is our next challenge. Proper reporting on this indicator is now included in our Sustainable Design Guide (first results from Groningen), so we will be able to capture and record this data for our redevelopment projects going forward, but it will take some time to build up a sufficiently large database to be able to extrapolate expected emissions from planned future redevelopments.

Collaboration with tenants

Building and maintaining strong relationships with our tenants is key. Although it can be challenging to engage with our tenants on our energy efficiency and emissions reduction ambition, we do see a slight shift here. In 2022 we interviewed 10 different tenants on their sustainability strategy, asking them about the importance to them of the energy intensity in their shops and what kind of energy contract they currently hold and for what period. We have offered our help to work together on energy efficiency on core and shell combined with measures in tenant fit-out at natural intervention moments. We have written anonymous records of these interviews and shared these with the interviewed contacts. We are convinced that early engagement and regular communication does lead to better environmental outcomes as well as increased tenant engagement. Through these interviews we have learned that the energy consumption in the stores is not the first of the tenant’s concerns, being about 2% of the ESG impact in their entire chain. We also learnt most of the tenants have a good insight of the energy consumption in their stores. Only one of the ten interviewed tenants proved to be very well informed about energy efficiency regulations and related subsidies on approved measures.

Collaboration with value chain partners

As stated earlier, we can have the greatest impact and improve the environmental performance of our assets when we engage in a proactive retrofit or redevelopment project. The earlier in the process we are able to embed the sustainability targets and rally the whole design team around the ambition, the better. This was the impetus for the development of our Sustainable Design Guide, which we now use as a clear statement of intent for all new projects. One challenge, however, is that we must occasionally encourage our own colleagues to start working with new design team partners – different architects, engineers and other advisory companies. It’s very natural to want to keep working with existing business partners where a strong relationship and track record has been developed; the risk, however, is that it may be harder to achieve a step-change in the ambition and way of working that will deliver the performance targets we’re now setting. We include forward-looking performance targets on operational energy intensity and carbon intensity using the CRREM pathways (Carbon Risk Real Estate Monitor). We are therefore regularly evaluating existing partners and identifying new value chain partners that share our ambition and even challenge us to proceed on this journey.

Wanting to set a high ambition for our projects also comes with challenges, as we have already experienced that current market practices, risk perceptions or planning regulations in different jurisdictions are deeply engrained and don’t (easily) permit innovative solutions or alternative materials use. For example, the desire to use mass timber for the structural frame of a new build can run into objections from a planning, fire safety or insurance perspective, despite the evidence from other countries around the world that mass timber meets all structural and safety requirements.

That said, we believe that we should continue to set the bar high, to demonstrate what is possible and in doing so, perhaps we’ll contribute to changing the perception and belief of others in the real estate value chain that real progress towards zero carbon buildings is possible.